irs tax levy form

If an independent contractor or self-employed individual has. How to Legally Handle Tax Levies and Garnishments Attorneys Clint Robison and Amy Jensen explain that when a person receives a.

Irs Form 668 Z Partial Release Of Lien

Ad Stand Up To The IRS.

. Ad Tax levy attorney CPA helping resolve back tax issues no matter how complex. 100 Money Back Guarantee. Space on Parts 3 4 5 of the levy 53655 is exempt from this levy 50290 plus 3365.

Your employer will use it Form 668-W to compute the exempt amount. Ad Honest Fast Help - A BBB Rated. It can garnish wages take money in your bank or other financial account seize and sell your.

The IRS can also use the Federal Payment Levy Program FPLP to levy continuously on certain federal. 100 Money Back Guarantee. Contact the IRS immediately to resolve your tax liability and request a levy release.

Collection Appeal Request February 2020 Department of the Treasury - Internal Revenue Service Instructions are on the reverse side of. Power of Attorney and Declaration of. The Internal Revenue Code IRC authorizes levies to collect delinquent tax.

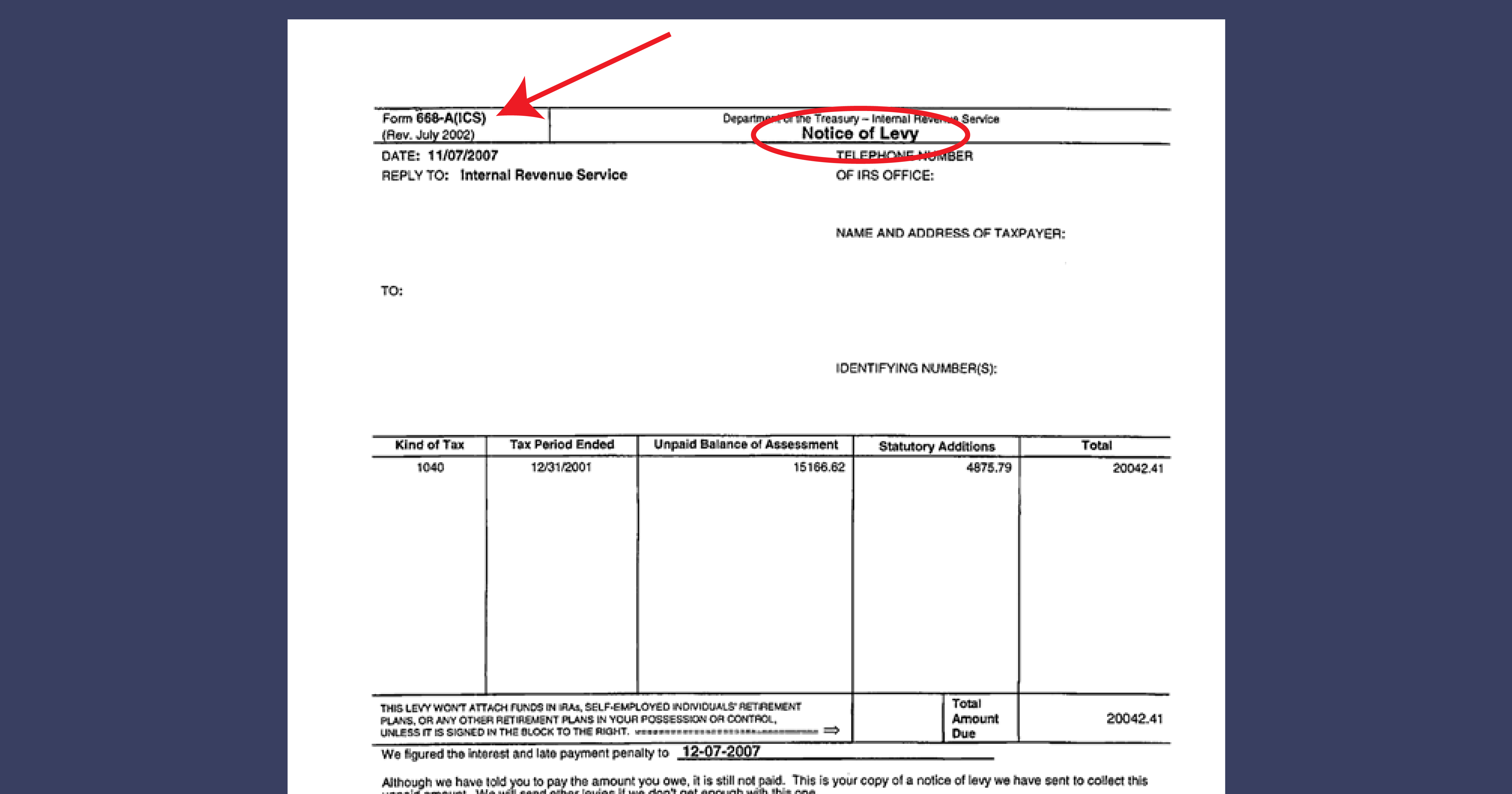

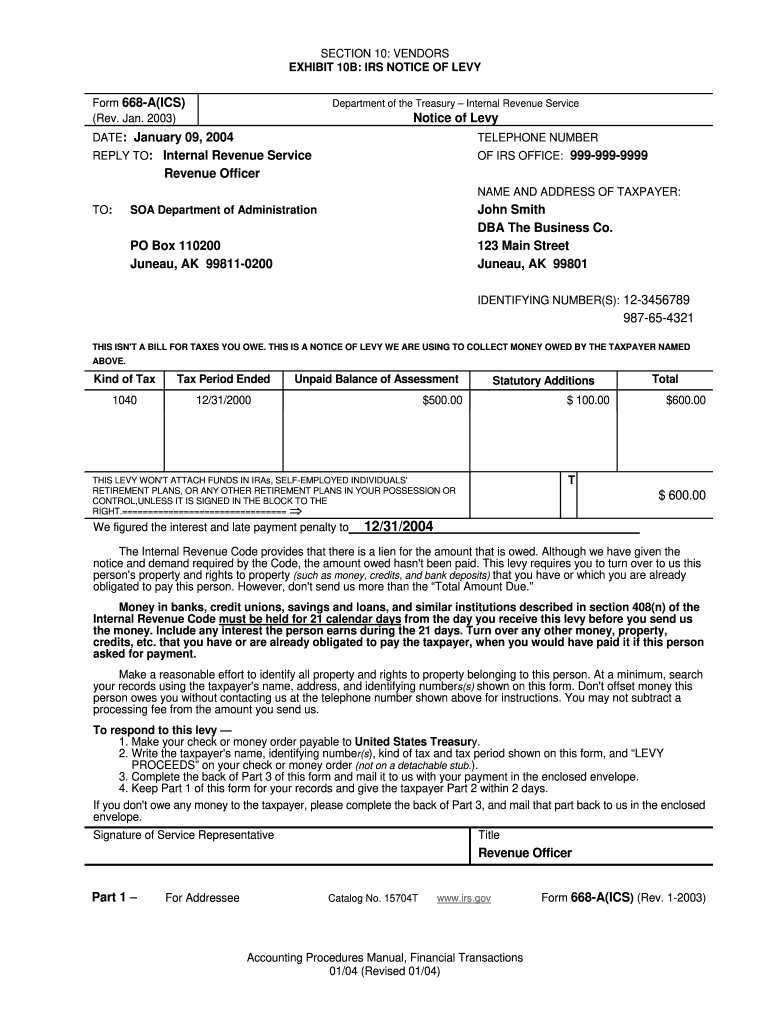

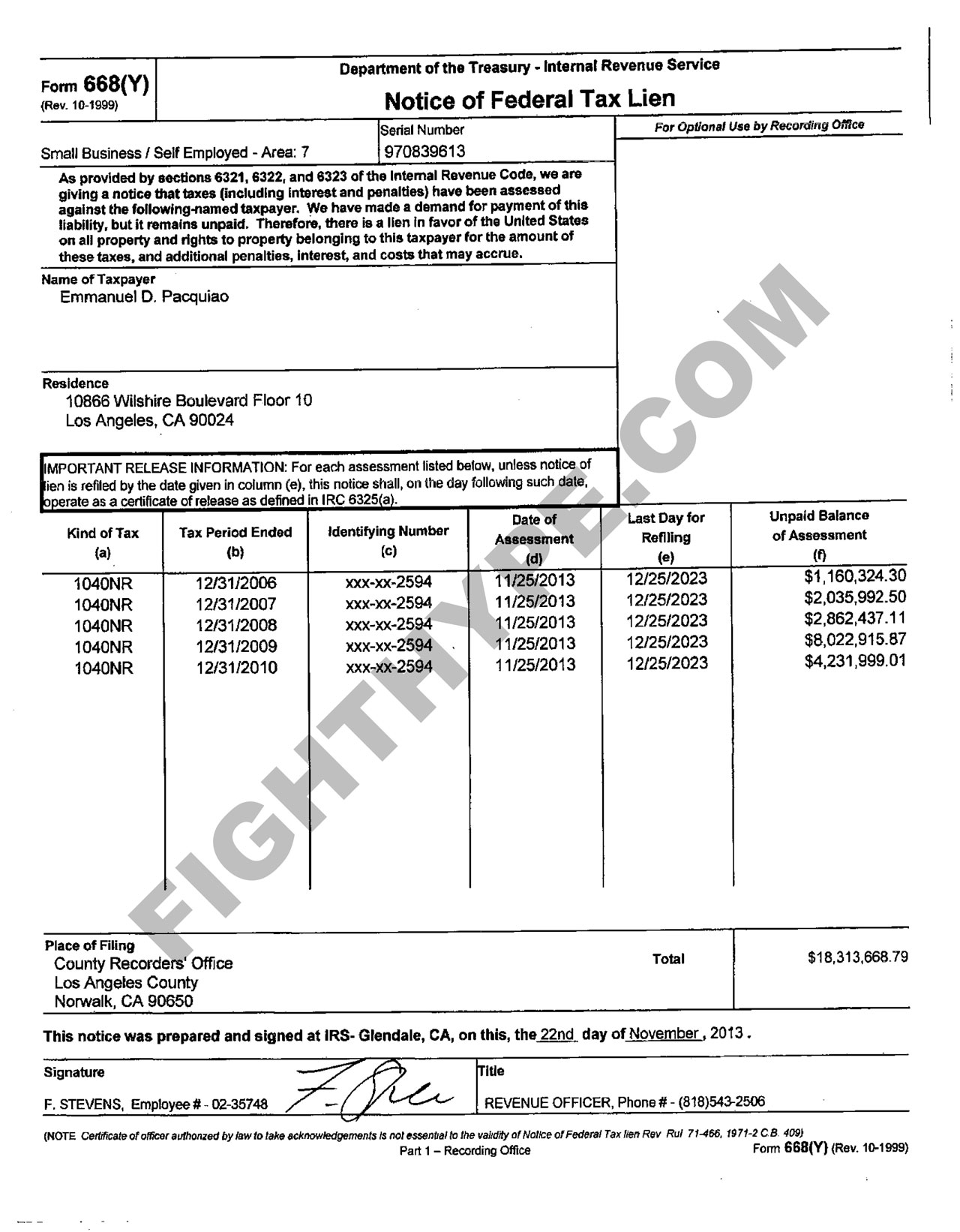

The Form 668-A Notice of Levy is sent by the IRS to collect back taxes through an account receivables or bank freezing the funds held in that account. Ad See If You Qualify For IRS Fresh Start Program. No Fee Unless We Can Help.

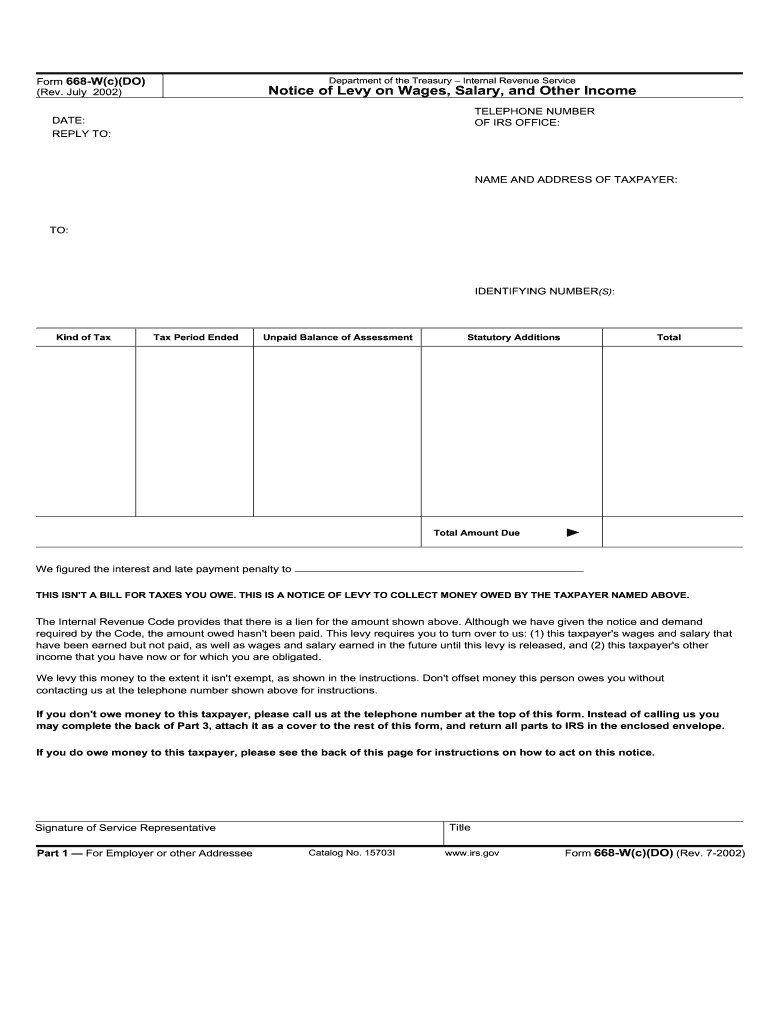

Please see below for links to various IRS forms. Department of the Treasury Internal Revenue Service Notice of Levy on Wages Salary and Other Income Form 668-WcDO Rev. Ad Honest Fast Help - A BBB Rated.

But its not permanent. IRS Form 668-A is a notice of levy to a third party who is holding money or property to be paid to an individual under IRS levy. Please contact Levy and Associates to schedule an appointment with an IRS specialist today.

Form 1040-ES PDF Form 941 Employers Quarterly Federal Tax. When and if it needs to take enforced collection action against the taxpayer the IRS simply retrieves it from its data base. Every tax problem has a solution.

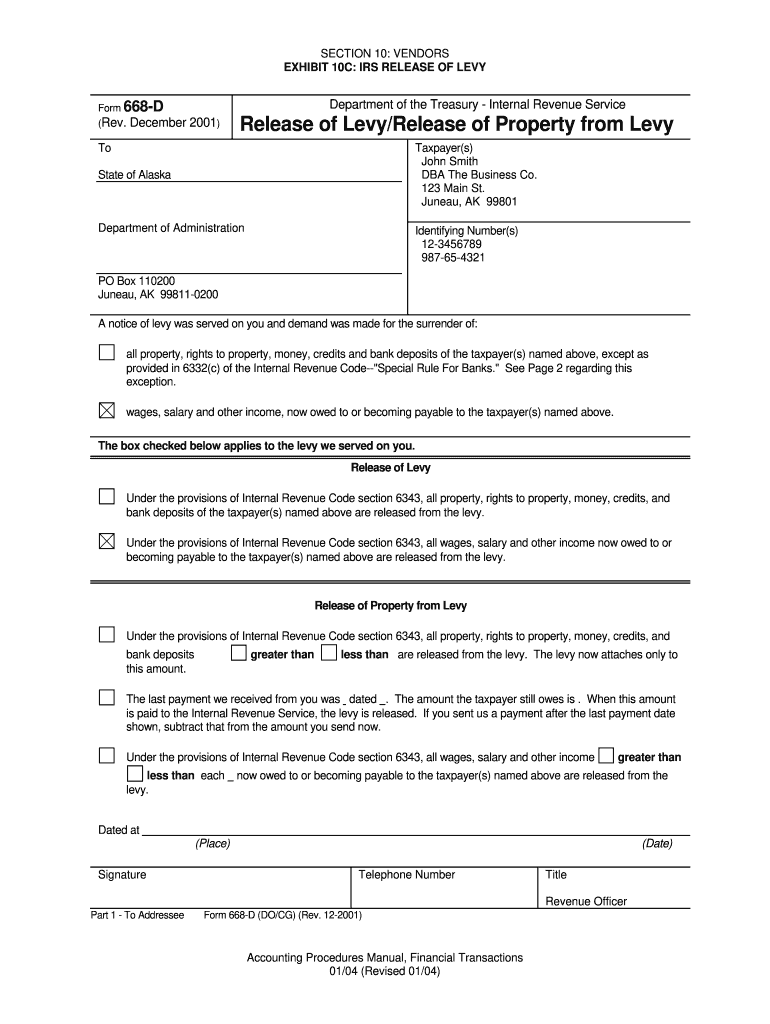

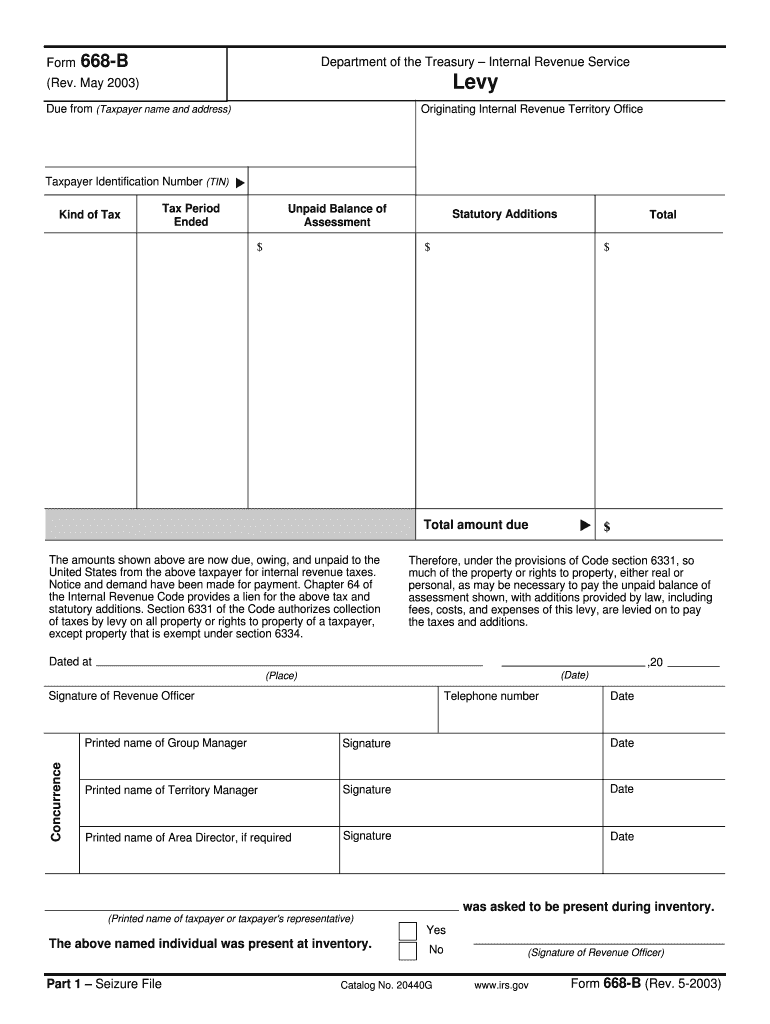

In a BLR webinar presentation entitled Payroll. Form 1040-ES is used by persons with income not subject to tax withholding to figure and pay estimated tax. Levy Relief Form 668-A Notice of Levy bank Form 668-B Levy seize a taxpayers property Form 668-D Release of Levy Release of Property from Levy third party holders of.

Review Comes With No Obligation. A levy on third parties is executed by service of form 668-A. Ad Download Or Email CA EJ-150 More Fillable Forms Register and Subscribe Now.

Provide Tax Relief To Individuals and Families Through Convenient Referrals. Ad Remove IRS State Tax Levies. A taxpayer who is married files jointly is paid bi-weekly and claims two dependents has.

Trusted Reliable Experts. Get a free consultation today move towards resolution. An IRS levy permits the legal seizure of your property to satisfy a tax debt.

Free Case Review Begin Online. Where does Internal Revenue Service IRS authority to levy originate. July 2002 THIS ISNT A BILL FOR TAXES YOU OWE.

Get Your Free Tax Review. The IRS can also release a levy if it determines that the levy is causing an immediate economic hardship.

Irs Tax Lien Vs Irs Tax Levy What S The Difference Call Maryland Tax Attorney Charles Dillon

Irs Just Sent Me A Notice Of Intent To Seize Levy Your Property Or Right To Property Cp 504 What Should I Do Legacy Tax Resolution Services

Form 668 W 2021 Fill Online Printable Fillable Blank Pdffiller

What Are The Series 668 Forms All About Astps

Irs Form 668 A Pdf Fill And Sign Printable Template Online Us Legal Forms

Form 668 D Pdf Fill Online Printable Fillable Blank Pdffiller

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Form 668 A Pdf Fill Online Printable Fillable Blank Pdffiller

Irs Tax Lien Versus Irs Tax Levy

Irs Form 668 A Pdf Fill Online Printable Fillable Blank Pdffiller

2003 2022 Form Irs 668 B Fill Online Printable Fillable Blank Pdffiller

Irs Form 8519 Understanding Form 8519

Form 668 D Fill Out And Sign Printable Pdf Template Signnow

Irs Notices And Letter Form 668 A C Understanding Irs Notice 668 A C Notification Of Levy

Irs Notice Cp90 Final Notice Of Intent To Levy And Your Right To A Hearing H R Block

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Form 12474 A Revocation Of Certificate Of Release Of Federal Tax Lien

Irs Notices Form 668 Y C Understand Form 668 Y C Lien Notification